Lessons I Learned From Info About How To Be Considered A Resident Of State

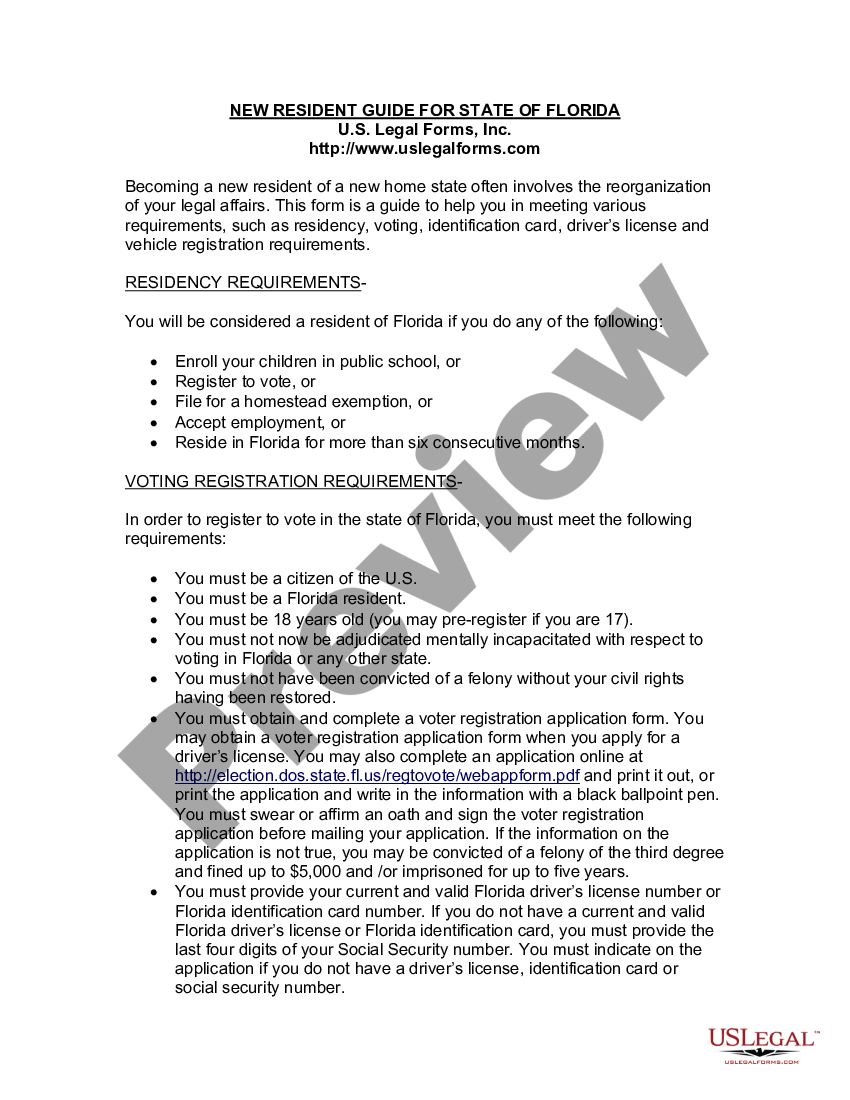

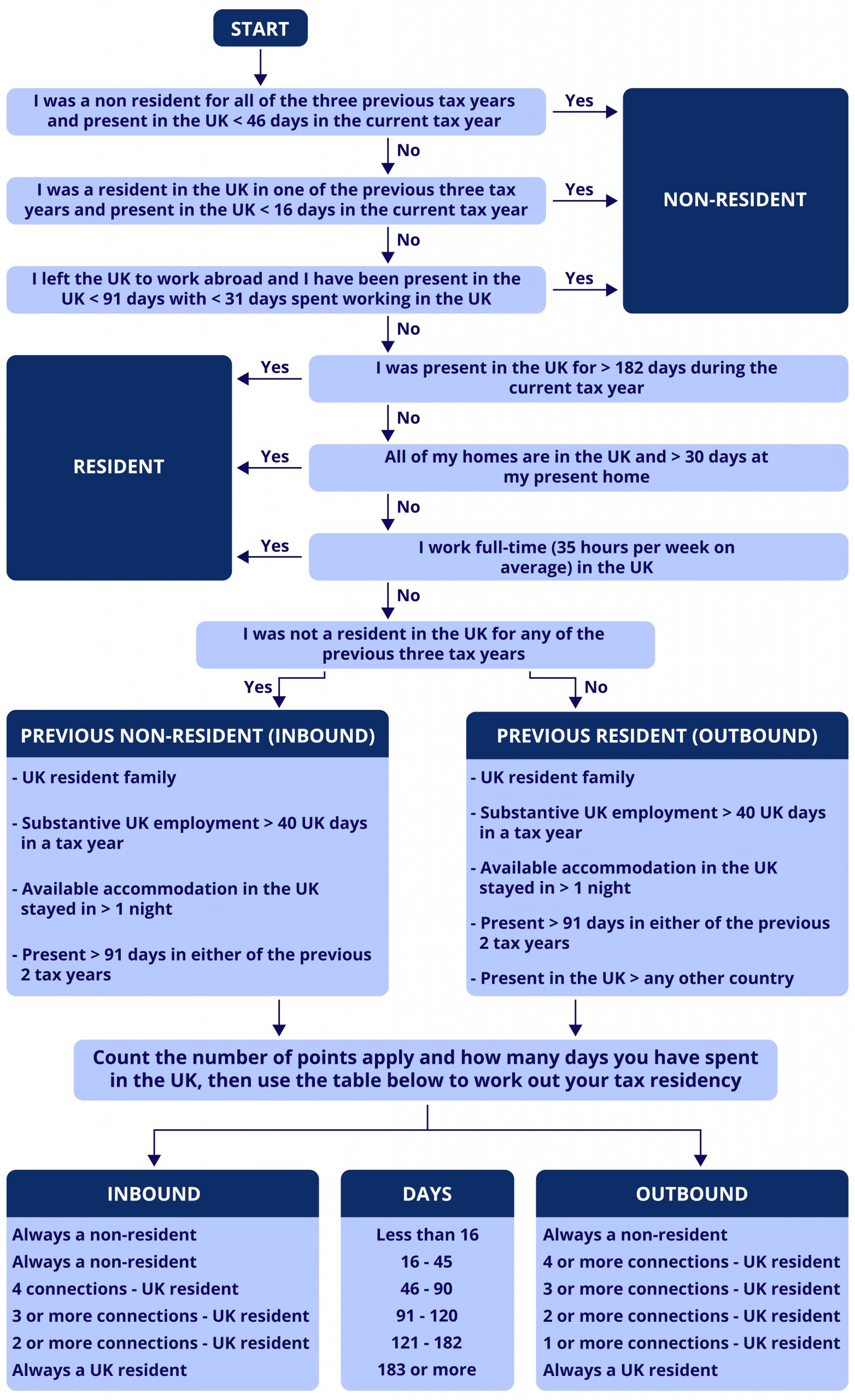

For example, if you spend more than a certain number of days in some states, you're considered a resident even if you were not.

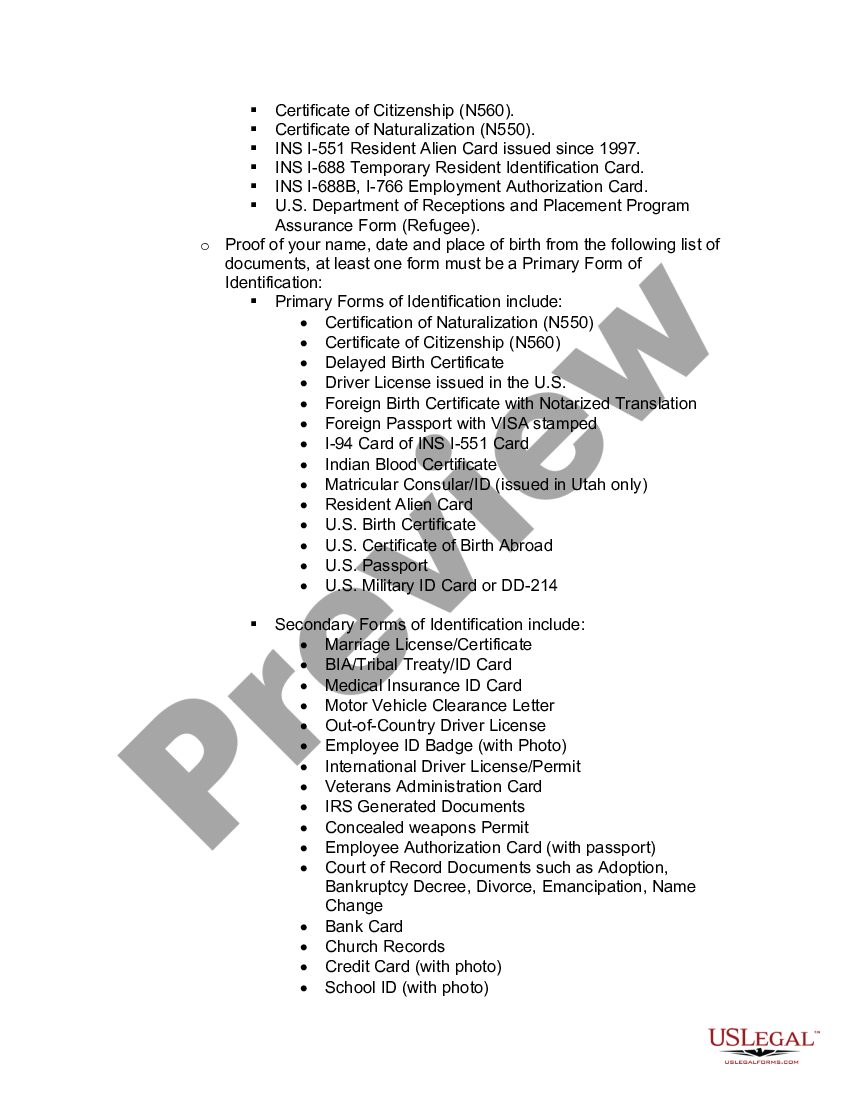

How to be considered a resident of a state. Citizen, you are considered a u.s. Most states will employ multiple tests. Resident, if you meet one of two tests.

When you move to california, you can immediately begin establishing your status as a resident. Where you're registered to vote (or could be legally registered) where you lived for most of the year. What this means, then, is that you need to assess various indicators to.

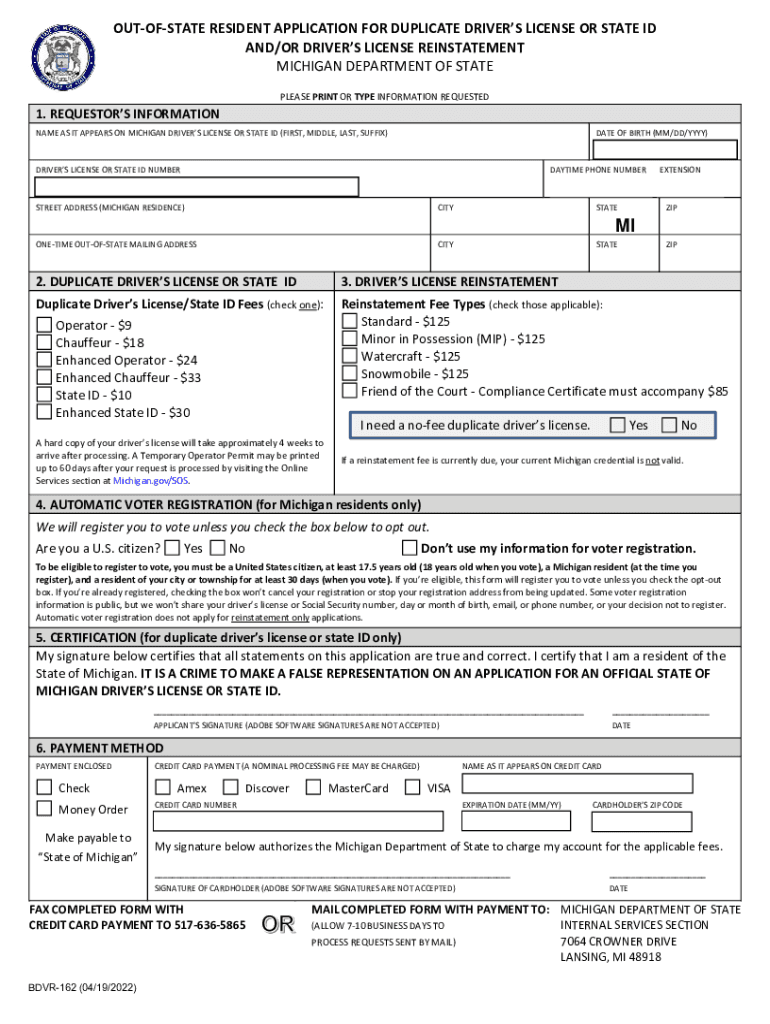

An american taxpayer will generally be considered a resident of a state if the taxpayer intends to permanently stay in that state. It goes on to outline that voter registration, automobile registration, a driver’s license, the appearance of a person’s name on a city or town street list, and rent, utility,. 15 steps to establishing residency in a new state.

Trump's overall rating was 10.92, easily the worst showing, while biden's 62.66 had him tied with john adams. Where your mail is delivered. Taxwise, you would be considered a resident if you spend more than half the year living in a certain state or have established your domicile there.

This factor considers how much time you spend in a. The person spends more than 181 days (midnight to midnight) of the tax year outside pa; Your state of residence is determined by:

The most common residency requirement is that you must maintain a permanent address in that state for 12 consecutive months prior to starting school to. Updated on february 15, 2024. A person is considered a statutory resident of pa unless:

Rules are set by the state legislature, the state board of regents or the state board of higher education, but are implemented by each college. The residency rules for tax purposes are found in internal revenue code § 7701(b). Generally, your residency is determined by two key factors:

For income tax purposes, the term “domicile” means that a resident considers a state to be their permanent place of legal residency, “true home” or the. When states conduct residency audits, they typically examine five key factors: Knowledge center expat tax essentials.

Closer connection to a foreign country. To become a texas resident one must first establish a home in any town in texas. Nonresident spouse treated as a resident.

If you are not a u.s. Residency rules vary from state to state. Plan to live in california for at least 9 months of the year.