Spectacular Tips About How To Reduce Receivables

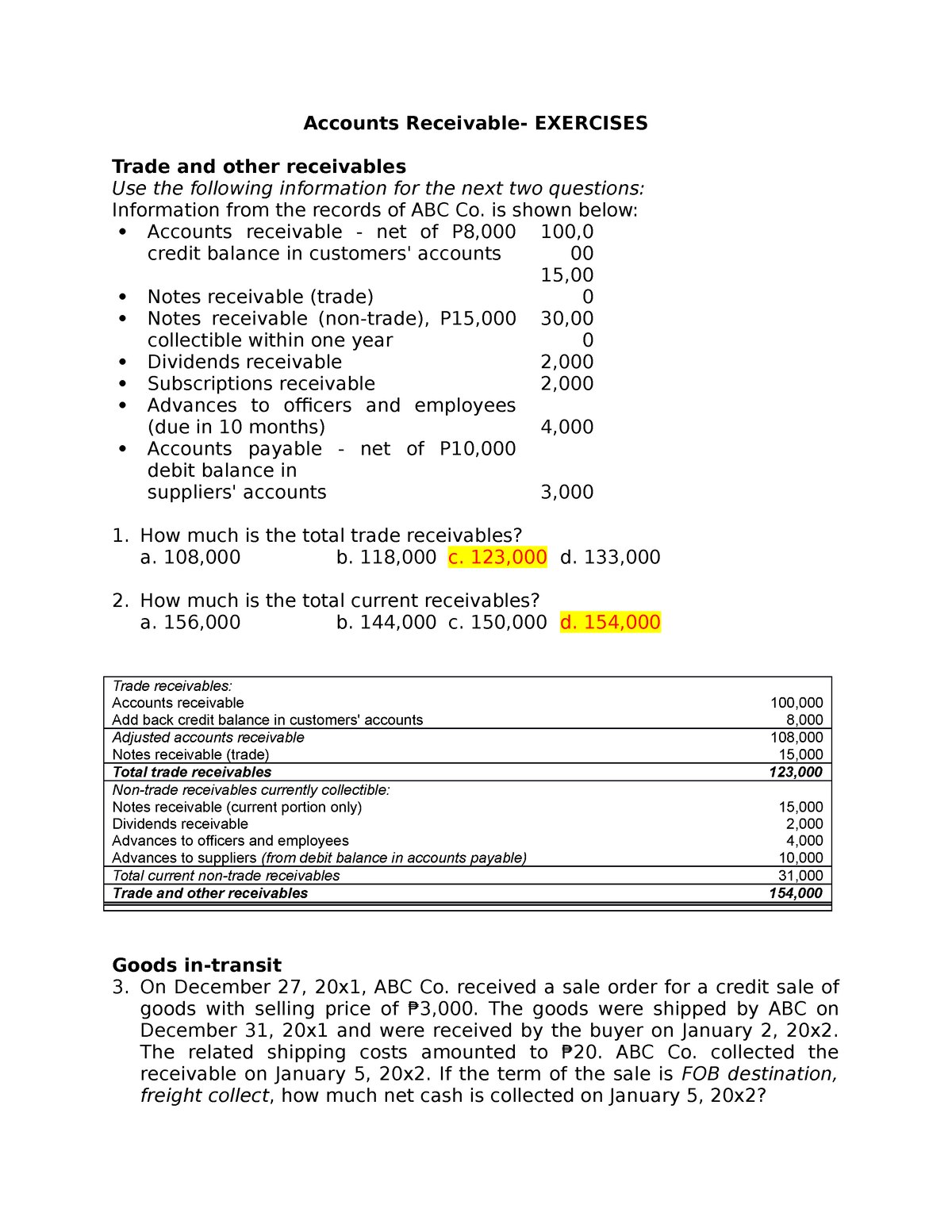

11 tips to improve your accounts receivable turnover 1.

How to reduce receivables. Establish clear expectations up front before ever signing a contract, a new customer should be aware of what is required of them when it’s billing time. Take your balance sheet for example. 6 useful strategies for improving accounts receivable 1.

There’s a better way to manage accounts receivable. 5 quick ways to reduce outstanding accounts receivables posted on april 9, 2020 by complete controller outstanding accounts receivables are among the most significant. What tasks can accounts receivable.

Most of the steps to eliminating overdue receivables also align with the steps of running a business well and treating people fairly and respectfully. Keep track of receivables. Your dso can impact your cash flow dso, or days sales outstanding, is an accounting metric that measures how many days it takes for a business to collect money for a credit.

If you’re using an accounts receivable automaton system that can send friendly reminders and past due emails for you, track email conversations, and provide. Can help to flag account anomalies (e.g.sales. This whitepaper covers 17 different strategies for reducing outstanding accounts receivable with the help of.

Keeping a close eye on receivables is a great way to ensure that you are getting paid in a timely manner and reducing bad debt. Accounts receivable days is an important key figure for companies, as it has an influence on the liquidity situation. Below are nine pivotal accounts receivable pain points, with insights into their impact on business operations.

Here are seven proven strategies for optimizing your ar to minimize the chances of experiencing cash flow issues. These might include days sales. Reduce delivery time and allow customers to download their invoices directly into their own accounting system • exception reports:

You’ll see a decrease in accounts receivable and total assets upon writing off an uncollectible account. Shortcuts what are the top accounts receivable challenges? What is the best solution for accounts receivable problems?

![What are the Receivables in Accounting? [Notes with PDF] Receivables](https://everythingaboutaccounting.info/wp-content/uploads/2020/09/What-are-the-receivables-in-Accounting_-1-1024x536.png)