Great Info About How To Apply For A Vat Number

Registering for vat purpose in a foreign country raises many practical questions:

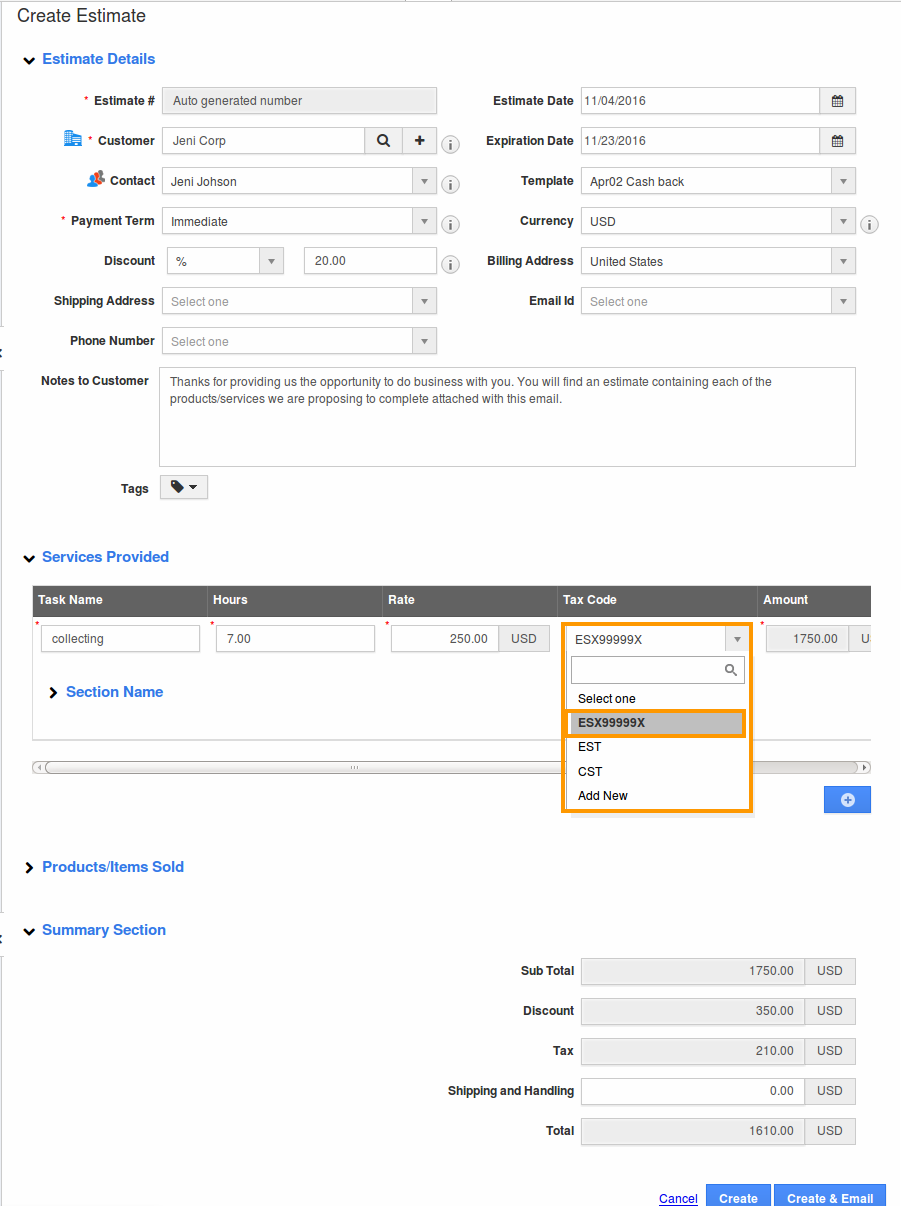

How to apply for a vat number. Make a list of all the eu countries where you’ll need to register for vat. January 10, 2024 fact checked. What documents do i need to provide to.

Often even one application is not enough and vat ids have to be. Register for vat either: How do i get a vat number?

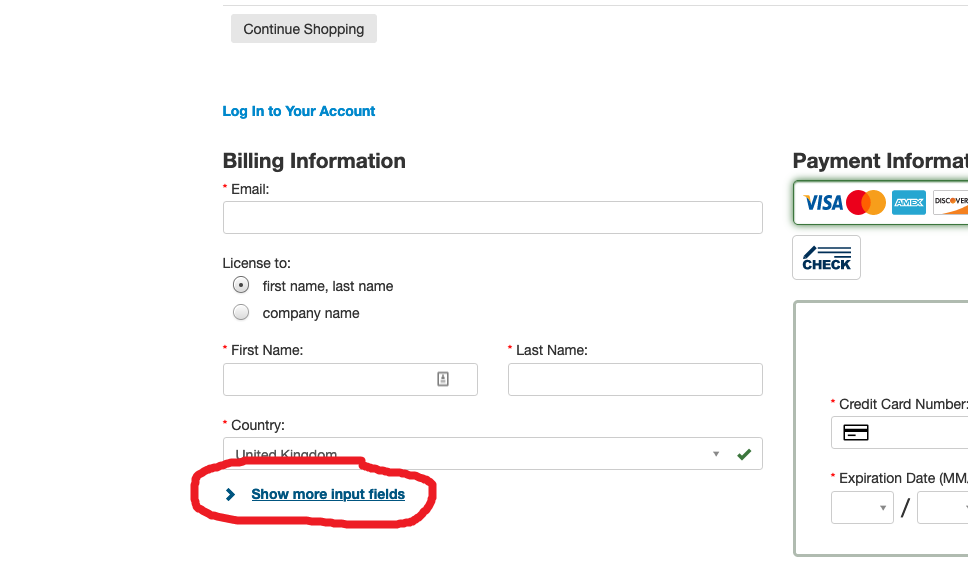

Immediate allocation of a new vat registration number upon. In order to submit an application for registration and get a vat number, you can go directly to the official website of the administration authority of the relevant country or ask for a. Register online through ros.

You must follow the normal vat rules if you sell goods imported in consignments with a value of more than £135. One of the most frequently asked vat related questions on search. New applicants may register for a vat number by completing the proper.

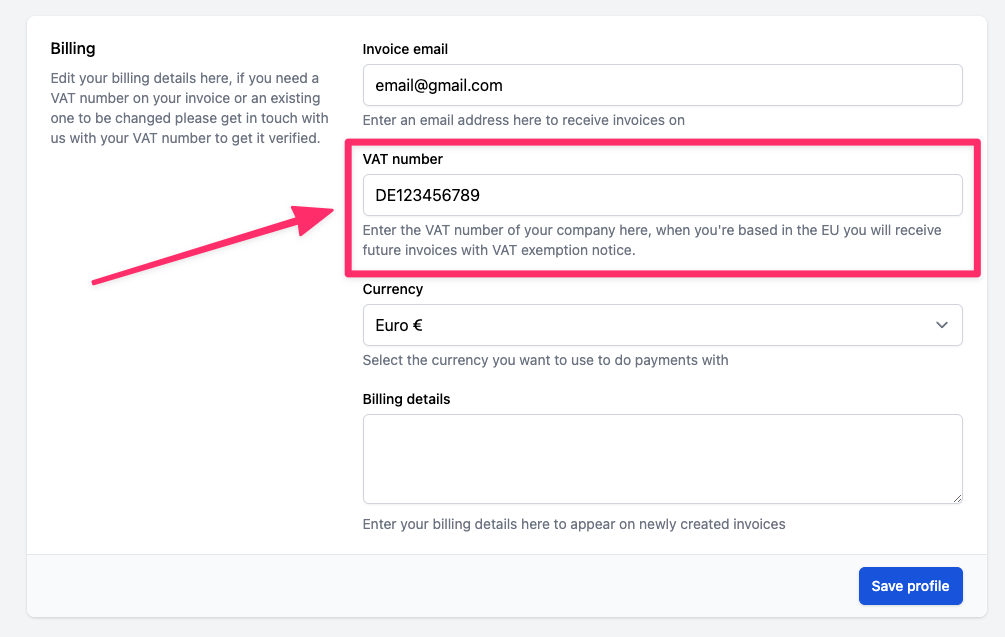

Learn when and how to register for vat in eu countries, the uk, norway, and switzerland. Gm professional accountants have offices located in canary. To register for an eu vat number:

How to apply for a vat number? How to register for a vat number. Check how to report and pay vat on distance.

How to register for eu vat? When does your company have to apply for a vat number abroad? The value added tax registration number (abbreviated ‘vat number’, or ‘vat reg no.’) is the individual.

How to get a vat number in the eu. Through the vat one stop shop (oss) union scheme. Find out more about consignments valued.

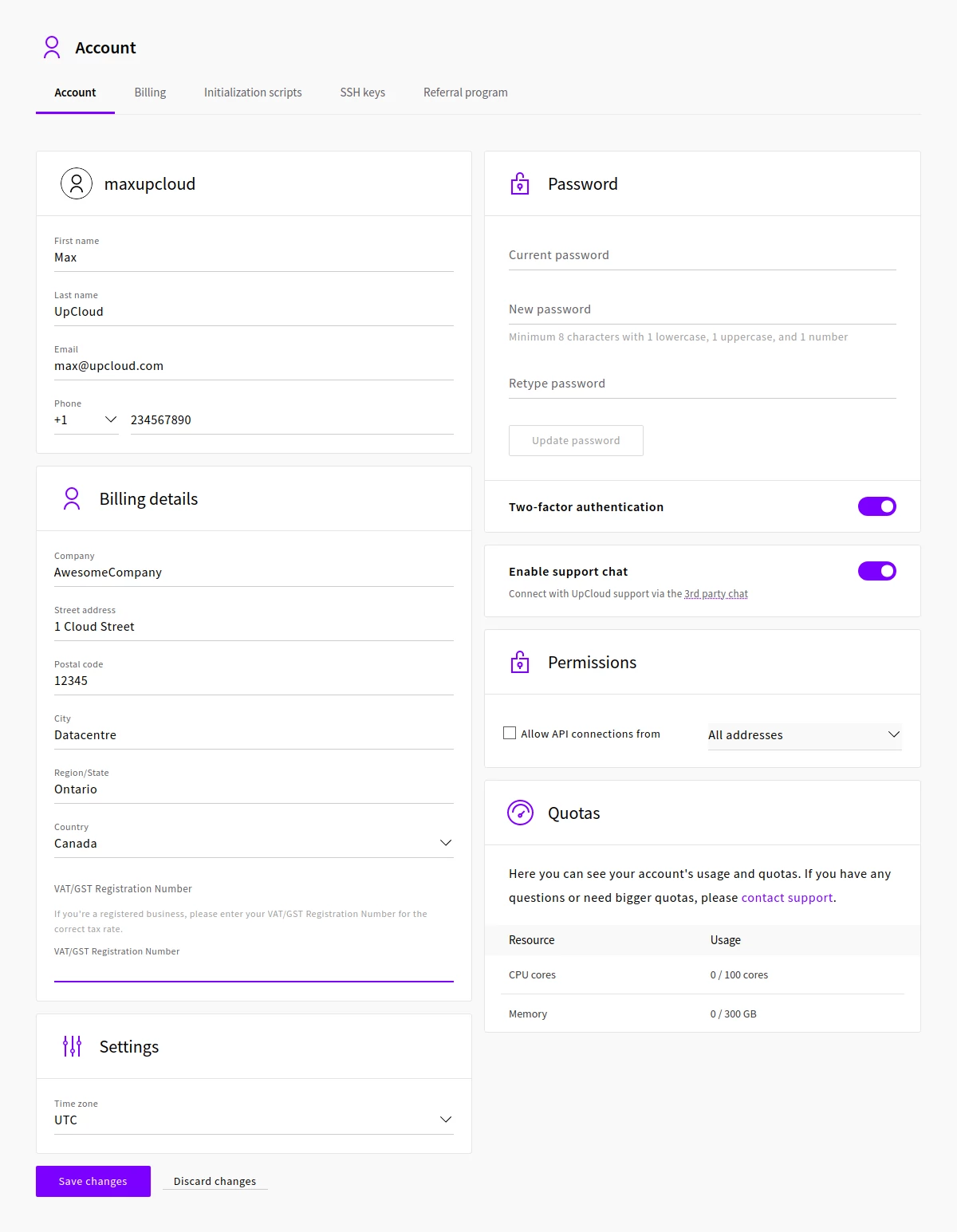

How to register for vat, change your details, cancel your registration, register for vat in eu countries. Navigating the vat registration process in europe. Value added tax, part 1.

Instructions, deadlines & more. If you run a business in a country that uses value. The vat number is a must for most european online sellers.